tax abatement definition government

Recently the GASB published GASB Statement No. In most jurisdictions there are multiple programs that abate property taxes if a person or the property is eligible.

What Is A Tax Abatement Should You Buy A Home With One Localize

An abatement is a tax break offered by a state or municipality on certain types of real estate or business opportunities.

. A portion of the disclosures required include a description of the program amount of the tax that is reduced the mechanism by which the. Property tax abatements are offered by some cities in the form of programs that reduce or eliminate property tax payments on qualifying property for a set amount of time to be determined on an individual case basis. Typically governments will offer tax abatements for a number of reasons such as.

Tax abatements typically take the form of a decrease in the amount of tax owing or a rebate being issued. This IRM provides guidance and instruction to SBSE employees in Field Collection for requesting abatements adjustments and processing reconsiderations. In some instances an abatement can also result in a reduction of penalties imposed.

A tax abatement is a government incentive that can lower or cut property taxes in a certain area. While tax abatements are most commonly associated with. In effect a tax abatement lowers the tax liability.

A company receiving a tax abatement enters into an agreement a contract with the state. An amount by which a tax is reduced. Tax abatements are a reduction of taxes granted by a government entity to a company for a specific period of time to encourage economic development.

For example if one receives a tax credit for purchasing a house one receives tax abatement because one pays less in taxes than heshe otherwise would. Such arrangements are known as tax abatements. A tax abatement is a property tax incentive offered by government agencies to decrease or eliminate real estate taxes in a specified location.

What are Tax Abatements. A sales tax holiday is another instance of tax abatement. While governments offer these incentives as a tax break or property tax abatement to improve the local economy it doesnt always work.

The primary audience for this IRM is Field Collection employees and their managers. Each contract allows a company to receive a predetermined reduction in its tax obligations. The appropriated budget was traditionally used to determine a governments property tax levy and a ceiling on expenditures was made absolute so that the expenditures of a government unit would not exceed its revenues.

Tax abatements are reductions in the amount of taxes an individual or company is responsible for paying. The primary purpose for this new requirement is to provide. Abatements can range in length from a few months to several years.

Tax abatement happens when a local government reduces or eliminates taxes for real estate properties. Property tax abatement is a decrease in the amount of money owed to a governmental tax authority on a real property tax bill. A tax abatement is when your tax obligations are reduced and in some cases eliminated for a certain period of time.

Penalty abatement removal is available for certain penalties under certain circumstances. Definition of tax abatement. Encourage companies make capital-intensive investments.

Cities and municipalities create tax abatement programs for the economic development of certain areas within their boundaries. Whether revitalization efforts will ultimately prove successful is a big question mark. A tax abatement is a reduction in the amount of taxes a business or individual must pay to the federal state or municipal levels of government.

IRS Definition of IRS Penalty Abatement. An abatement is a reduction or an exemption of a tax for an individual or a company. Encourage a certain type of investment.

Tax abatements are a reduction of taxes granted by a government entity to a company for a specific period of time to encourage economic development. A reduction in tax revenues that results from an agreement between one or more governments and an individual or entity in which a one or more governments promise to forgo tax revenues to which they are otherwise entitled and b the individual or entity promises to take a specific action after the agreement has been entered into that contributes to economic. To increase savings or spending rate invest in equipment or others.

The disclosures are extensive and should be organized by each major type of tax abatement program. These incentives provide considerable savings for individuals and companies. If your government has programs that meet the tax abatement definition certain disclosures are required.

The policy owner of this IRM section is the Director Collection Policy. Tax abatement defined as the decreasing of the tax responsibility of a firm by government is one of the tools which government uses to motivate behavior in a firm. Tax abatement is a reduction in tax revenues that.

More from HR Block. A tax abatement is a local agreement between a taxpayer and a taxing unit that exempts all or part of the increase in the value of the real property andor tangible personal property from taxation for a period not to exceed 10 years. A reduction of taxes for a certain period or in exchange for conducting a certain task.

Property tax abatement is a decrease in the amount of money owed to a governmental tax. A tax abatement credit is generally given to a firm when the government wants the saved money to be spent in another way. The tax abatement is an incentive to encourage people to redevelop and move into these areas.

You may qualify for relief from penalties if you made an effort to comply with the requirements of the law but were unable to meet your tax obligations due to circumstances beyond your control. 77 Tax Abatement Disclosures that will require those state and local governmental entities that offer tax abatements to provide details about the program or programs in the note disclosures. Under the GASB Statement 77 tax abatements have a narrow definition.

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Chapter 353 Tax Abatement Department Of Economic Development

Sales And Use Tax Regulations Article 3

Understanding Incentives In The Automotive Industry

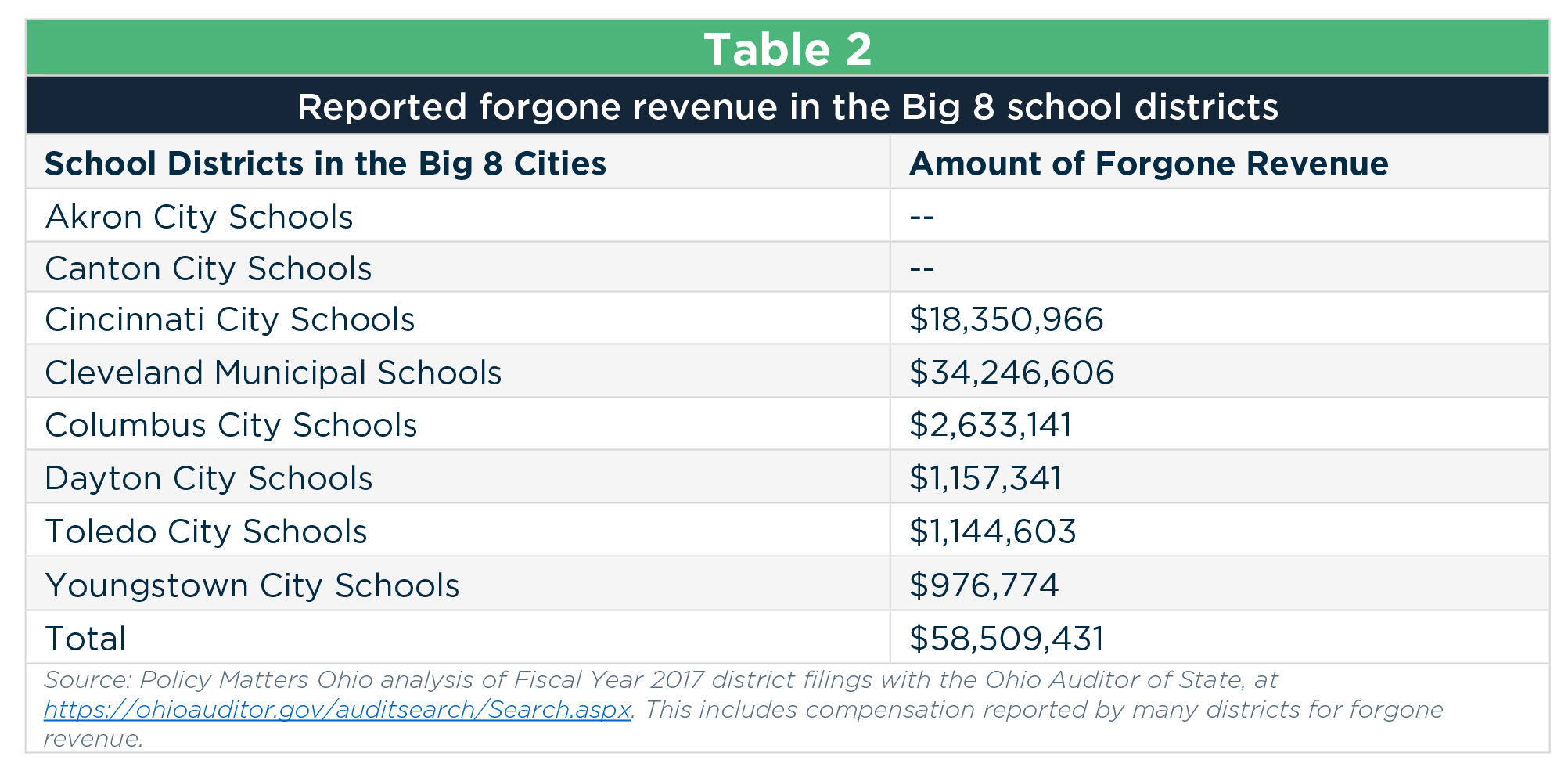

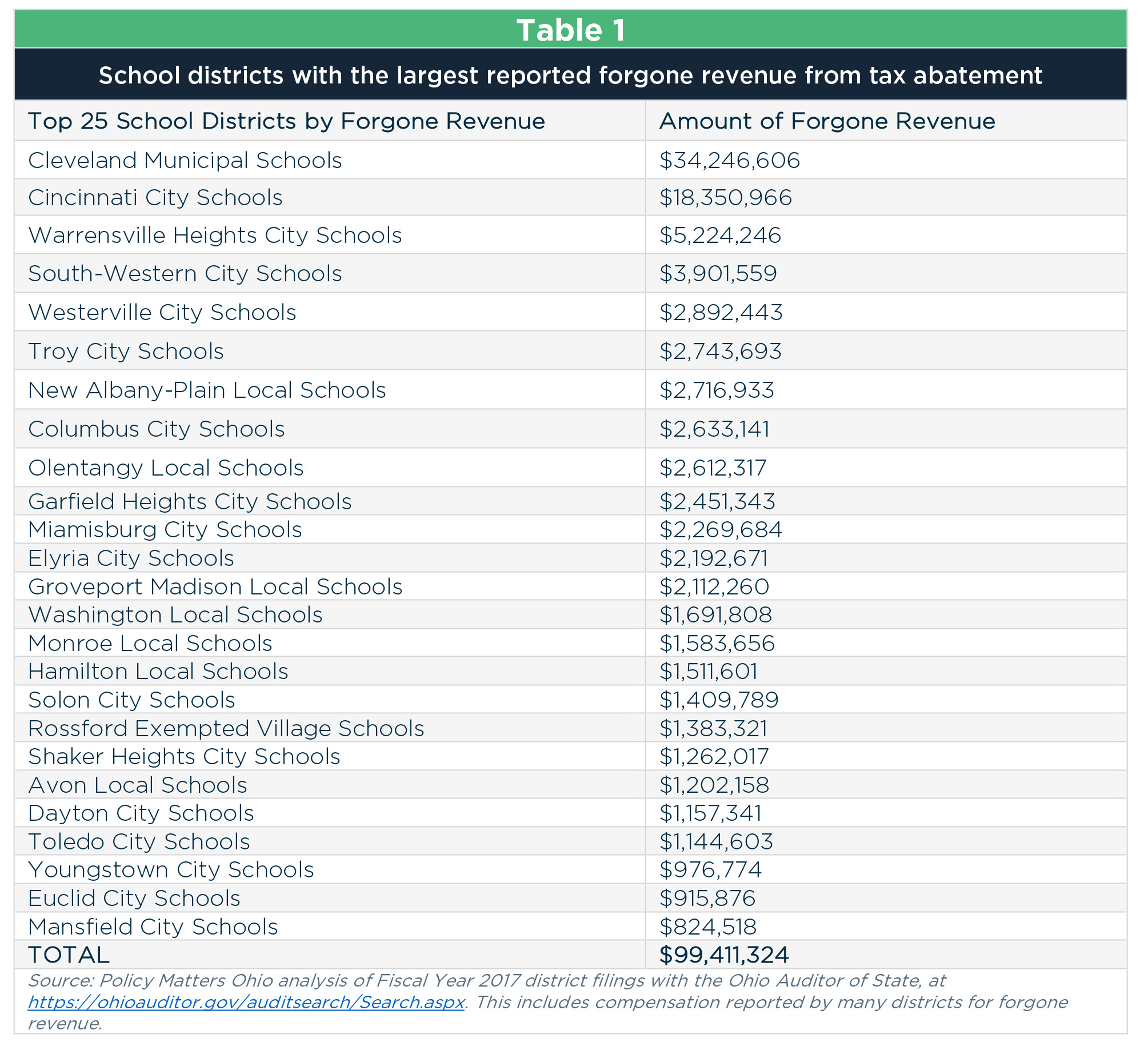

Tax Abatements Cost Ohio Schools At Least 125 Million

What Is A Tax Abatement Should You Buy A Home With One Localize

Tax Abatements Cost Ohio Schools At Least 125 Million

How Do I Know If I Am Exempt From Federal Withholding

Sales And Use Tax Regulations Article 3

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Sales And Use Tax Regulations Article 3

Tax Abatement How Does It Help You Save On Property Taxes Mybanktracker